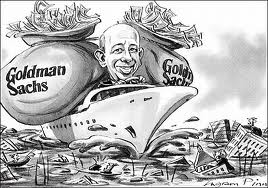

Goldman Sachs Gets Break on Derivatives Regulation

Rather than delaying reform of derivatives for banks that are backed by federal deposit insurance (thus making the taxpayer liable for paying for investment banking risks), why not take away the commercial part of these investment banks? Investment banks make the risky bets and investment banks should pay for their own risks without any help from taxpayer insurance.

Better yet, outlaw altogether all derivatives that are based on speculation! The financial crisis of 2008 was directly a result of the use of toxic derivatives instruments called CDOs.

JPMorgan to BofA Get Delay on Rule Isolating Derivatives

JPMorgan Chase & Co. (JPM), Goldman Sachs Group Inc. (GS) and Bank of America Corp. won a delay of Dodd-Frank Act requirements that they wall off some derivatives trades from bank units backed by federal deposit insurance.

Commercial banks including the Wall Street firms may get as long as an additional two years — until July 2015 — to comply with the rules, the Office of the Comptroller of the Currency said in a notice yesterday. The so-called pushout provision was included in the 2010 financial-regulation law as a way to limit taxpayer support for risky derivatives trades.

Enlarge image

JPMorgan & Chase Co.’s headquarters in New York. Photographer: Peter Foley/Bloomberg

Sponsored Links

Buy a link

The Commodity Futures Trading Commission and other regulators need to complete swap rules to allow “federal depository institutions to make well-informed determinations concerning business restructurings that may be necessary,” the OCC said in the notice. Dodd-Frank requires that equity, some commodity and non-cleared credit derivatives be moved into separate affiliates without federal assistance.

Regulators including Federal Reserve Chairman Ben S. Bernanke had opposed the provision, saying it would drive derivatives to less-regulated entities. In February, the House Financial Services Committee approved with bipartisan support legislation that would let banks keep commodity and equity derivatives in insured units by removing part of the rule.

The OCC is prepared to “consider favorably” requests for transition, the regulator said in the six-page notice. The agency said delays could be extended for a third year based on consultations with other regulators.

OCC Report

JPMorgan had 99 percent of its $72 trillion in notional swaps trades in its commercial bank in the third quarter of 2012, according to the OCC’s quarterly derivatives report. Bank of America had 68 percent of its $64 trillion in its commercial bank, according to the report.

Banks including Citigroup Inc. (C) will be given as long as two years beyond the July 16 deadline to move their swaps businesses, the OCC said. They must submit written requests describing how a transition period would reduce harmful effects on mortgage lending, job creation and capital formation. The requests, which must be submitted by Jan. 31, also must weigh how the transition period would affect insured depositors.

Other Regulators

The Federal Deposit Insurance Corp. expects to release rules or guidance in coordination with other regulators that apply to different types of banks, Andrew Gray, the agency’s spokesman, said today in an e-mail. None of the 65 firms that registered as swap dealers with the CFTC by the end of last year are directly overseen by the FDIC, Gray said.

The Federal Reserve has primary oversight of swap dealers that have registered with CFTC including Bank of New York Mellon Corp. and Goldman Sachs Bank USA. The pushout provision’s impact on uninsured U.S. branches and agencies of foreign banks is also unresolved by the OCC’s guidance and lack of guidance from the FDIC and the Fed.

The uninsured branches of foreign banks should be given the same treatment as U.S. insured depository banks, Sally Miller, CEO of the Institute of International Bankers, said in an e-mail today. “It is imperative that this disparity of treatment be addressed quickly,” said Miller, whose organization represents banks including Credit Suisse AG (CSGN) and Deutsche Bank AG.

Eric Kollig, a Fed spokesman, declined to comment on the Fed’s approach to the issue.

‘Pretty Amazing’

“The procrastination of both regulators and the banks on this portion of Dodd-Frank has been pretty amazing,” Marcus Stanley, policy director for Americans for Financial Reform, a coalition including the AFL-CIO labor federation, said yesterday in a telephone interview. “The swaps-pushout provision is a really important part and something that absolutely should be a central part of the regulatory framework.”

Blanche Lincoln, an Arkansas Democrat who led the Senate Agriculture Committee during talks leading to Dodd-Frank, sponsored the original provision in 2010. It applied to more more types of derivatives before it was scaled back amid objections from Bernanke and former FDIC Chairman Sheila Bair.

“I never myself thought it made a great deal of sense,” Barney Frank, the Massachusetts Democrat who helped draft the Dodd-Frank law and whose last day in Congress was yesterday, said on Feb. 16 when he backed changes to the pushout provision.

Ken Bentsen, executive vice president of public policy and advocacy at the Securities Industry and Financial Markets Association, said Congress should still seek changes.

“We continue to believe that the underlying swaps push out provision is bad policy,” Bentsen said yesterday in an e-mail, noting that regulators haven’t proposed how the provision would work. “Given this uncertainty, it is impractical to require compliance by July 2013,” he said.

To contact the reporter on this story: Silla Brush in Washington at sbrush@bloomberg.net

Posted on March 3, 2013, in buisiness, Government, USA, Wealth and tagged Bank of America, Banks, Commodity Futures Trading Commission, Dodd-Frank, Dodd–Frank Wall Street Reform and Consumer Protection Act, Goldman Sach, JPMorgan Chase, The Bank of New York Mellon, Wall Street. Bookmark the permalink. 3 Comments.

Reblogged this on Phi Asset Managers.

I was suggested this blog through my cousin. I’m now not sure whether or not this post is written by means of him as no one else realize such distinct about my difficulty. You are wonderful! Thanks!

Thankyou